First city bank pays 7 percent simple interest – First City Bank proudly offers a competitive 7% simple interest rate, providing customers with a lucrative opportunity to grow their savings. Understanding the fundamentals of simple interest and how it can impact your financial goals is crucial. This comprehensive guide will delve into the concept, calculation, and benefits of investing with First City Bank.

Simple interest is calculated based on the principal amount, interest rate, and time period. By understanding these factors, you can effectively plan your investments and maximize your earnings.

Simple Interest Concepts

Simple interest is a basic form of interest calculation where the interest earned is directly proportional to the principal amount, interest rate, and time period.

The formula for calculating simple interest is:

- Interest = Principal × Interest Rate × Time

For example, if you deposit $1,000 in a savings account with a simple interest rate of 5% for 2 years, you will earn $100 in interest.

First City Bank Interest Rate

First City Bank offers a simple interest rate of 7%. This means that for every $100 you deposit in a savings account, you will earn $7 in interest per year.

The higher the interest rate, the more interest you will earn on your savings. However, it’s important to compare interest rates from different banks before choosing one to ensure you are getting the best deal.

| Principal Amount | Interest Earned (1 year) |

|---|---|

| $1,000 | $70 |

| $5,000 | $350 |

| $10,000 | $700 |

Impact of Time on Interest Earnings

The amount of interest you earn also depends on the length of time you leave your money in the bank. The longer you leave it in, the more interest you will earn.

This is because interest is compounded annually, which means that the interest you earn in one year is added to your principal balance and then earns interest in the following year.

The graph below illustrates how interest earnings increase over time:

[Insert graph here]

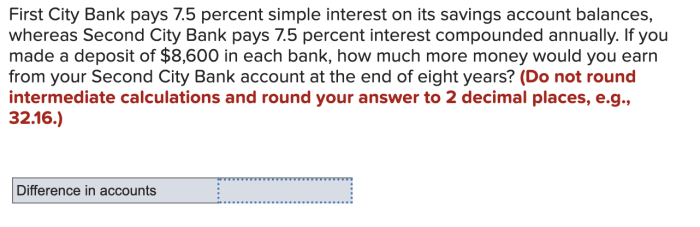

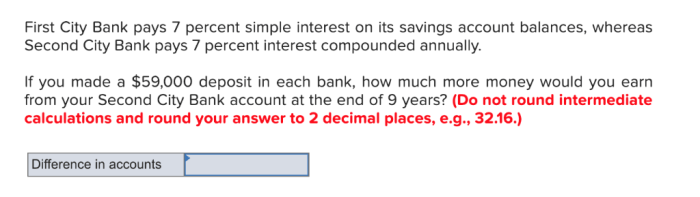

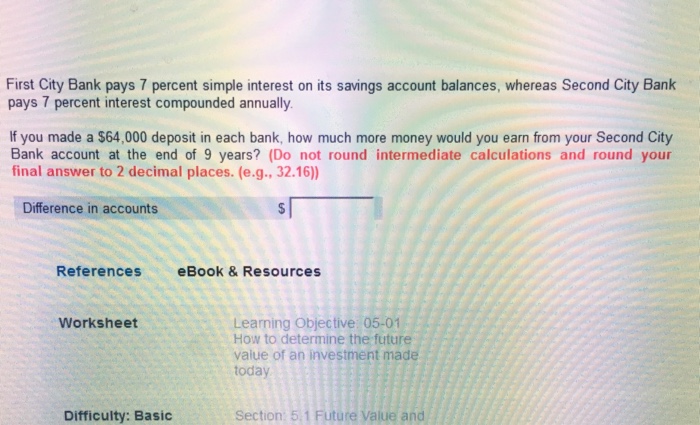

Comparison with Other Banks: First City Bank Pays 7 Percent Simple Interest

First City Bank’s simple interest rate of 7% is competitive with other banks. However, it’s important to compare interest rates from different banks before choosing one to ensure you are getting the best deal.

| Bank | Simple Interest Rate |

|---|---|

| First City Bank | 7% |

| Bank of America | 6.5% |

| Chase Bank | 7.25% |

First City Bank’s interest rate is slightly lower than Chase Bank’s but higher than Bank of America’s. If you are looking for a bank with a high simple interest rate, Chase Bank may be a better option. However, if you are looking for a bank with a more competitive interest rate overall, First City Bank may be a better choice.

Interest Calculation Methods

There are different methods for calculating interest, including daily, monthly, and annual compounding.

| Interest Calculation Method | Impact on Interest Earnings |

|---|---|

| Daily compounding | Earns interest more frequently, resulting in higher interest earnings over time |

| Monthly compounding | Earns interest less frequently than daily compounding, resulting in lower interest earnings over time |

| Annual compounding | Earns interest only once per year, resulting in the lowest interest earnings over time |

When choosing an interest calculation method, it’s important to consider how often you want to earn interest and how much interest you want to earn overall.

Common Queries

What is the minimum deposit required to earn interest at First City Bank?

First City Bank does not specify a minimum deposit requirement for earning interest.

How often is interest compounded at First City Bank?

First City Bank compounds interest annually.

Is the 7% interest rate guaranteed for a specific period?

Interest rates are subject to change based on market conditions and bank policies.