Use only the appropriate accounts to prepare a balance sheet – In the realm of accounting, the balance sheet stands as a crucial financial statement that provides a snapshot of a company’s financial health at a specific point in time. To ensure the accuracy and reliability of this statement, it is imperative to adhere to the principle of using only appropriate accounts during its preparation.

This comprehensive guide will delve into the significance of account selection, the criteria for identifying appropriate accounts, and the step-by-step process of constructing a balance sheet using these accounts. By understanding and applying these principles, accountants can effectively present a clear and accurate picture of a company’s financial position.

Understanding the Importance of Account Selection

When preparing a balance sheet, using only appropriate accounts is crucial for ensuring its accuracy and reliability. Inappropriate account usage can lead to misstated financial information, which can have significant consequences for stakeholders.

For instance, including a capital expenditure as an expense would overstate expenses and understate assets, resulting in an inaccurate portrayal of the company’s financial position.

Identifying Appropriate Accounts: Use Only The Appropriate Accounts To Prepare A Balance Sheet

Appropriate accounts for balance sheet preparation are determined by their relevance to the company’s financial position. These accounts typically fall into three main categories:

- Assets:Resources owned or controlled by the company with future economic value.

- Liabilities:Obligations owed by the company to other parties.

- Equity:The residual interest in the assets of the company after deducting liabilities.

Verifying Account Balances

Before including account balances in the balance sheet, it is essential to verify their accuracy. This can be done through reconciliation, which involves comparing account balances to independent sources such as bank statements or vendor invoices.

Reviewing supporting documentation, such as purchase orders or invoices, can also provide evidence of the accuracy of account balances.

Constructing the Balance Sheet

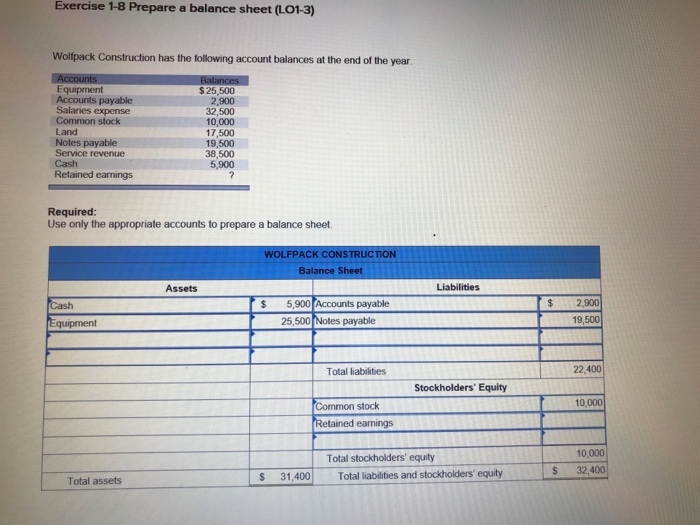

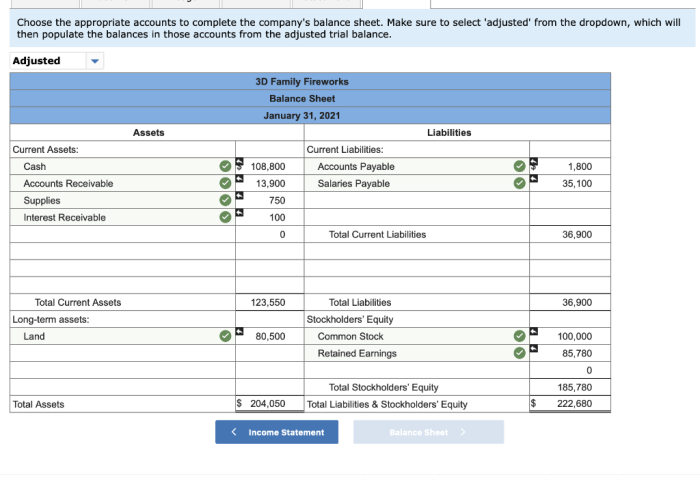

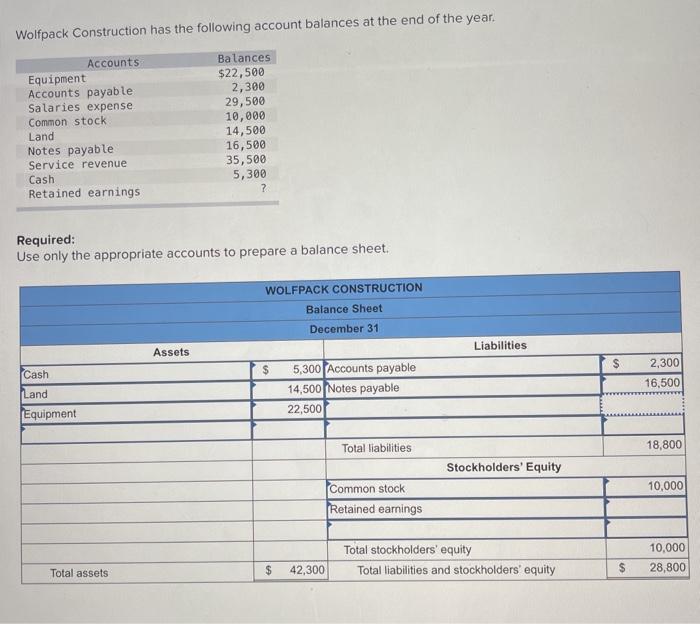

To construct a balance sheet, follow these steps:

- Gather account balances:Collect the balances of all relevant accounts as of the balance sheet date.

- Classify accounts:Categorize accounts into assets, liabilities, and equity.

- Organize accounts:Arrange accounts within each category in order of liquidity or maturity.

- Prepare a balance sheet template:Create a table with three columns: Assets, Liabilities, and Equity.

- Enter account balances:Populate the balance sheet with the verified account balances.

- Balance the balance sheet:Ensure that the total assets equal the total liabilities plus equity.

| Assets | Liabilities | Equity |

|---|---|---|

| Cash | Accounts Payable | Share Capital |

| Accounts Receivable | Notes Payable | Retained Earnings |

| Inventory | Long-Term Debt | |

| Fixed Assets |

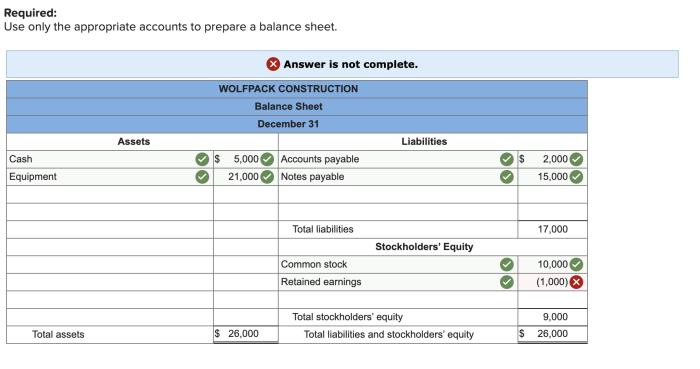

Common Errors and Mitigation

Common errors in using inappropriate accounts in a balance sheet include:

- Mixing expense and capital accounts:Treating capital expenditures as expenses.

- Incorrect classification of liabilities:Misclassifying current liabilities as long-term liabilities.

- Omission of accounts:Failing to include all relevant accounts in the balance sheet.

To mitigate these errors, it is important to:

- Establish clear accounting policies:Define the criteria for classifying and recording transactions.

- Train accounting staff:Ensure that staff understands the appropriate use of accounts.

- Implement internal controls:Establish procedures to prevent and detect errors.

FAQs

What are the consequences of using inappropriate accounts in a balance sheet?

Inappropriate account usage can lead to inaccurate financial reporting, misrepresentation of a company’s financial position, and difficulty in making informed financial decisions.

How can I verify the accuracy of account balances before including them in the balance sheet?

Account balances can be verified through reconciliation, which involves comparing account balances to independent sources such as bank statements or invoices, and reviewing supporting documentation such as purchase orders or contracts.

What are some common errors that can occur when using inappropriate accounts in a balance sheet?

Common errors include using accounts that are not relevant to the balance sheet, double-counting or omitting accounts, and using incorrect account balances.