The appointment of the new chairman of the Ionian Central Bank marks a significant milestone in the financial landscape of the region. This esteemed individual, renowned for their expertise and visionary leadership, is poised to shape the course of monetary policy and guide the Ionian economy towards a prosperous future.

With a deep understanding of economic dynamics and a proven track record of success, the new chairman brings a wealth of experience to this pivotal role. Their insights and strategic direction will undoubtedly have a profound impact on interest rates, inflation, and the overall stability of the Ionian financial system.

The Ionian Central Bank: A New Era: The New Chairman Of The Ionian Central Bank

The Ionian Central Bank, established in 1963, is the central bank of the Ionian Republic. It is responsible for managing the country’s monetary policy, regulating the financial sector, and maintaining price stability. In 2023, Dr. Sophia Athanasiou was appointed as the new chairman of the bank.

Background on the Ionian Central Bank

The Ionian Central Bank has a long history of maintaining monetary stability and fostering economic growth. It has successfully implemented a number of monetary policy initiatives, including targeting inflation and managing interest rates. The bank’s key performance indicators, such as inflation rate, GDP growth, and financial sector stability, have consistently met or exceeded expectations.

Introduction of the New Chairman

Dr. Sophia Athanasiou is a highly respected economist with over 30 years of experience in the financial sector. She holds a PhD in Economics from the University of Oxford and has held senior positions at the International Monetary Fund and the European Central Bank.

Dr. Athanasiou’s appointment was widely welcomed by the financial community, as she is known for her expertise in monetary policy and her commitment to financial stability.

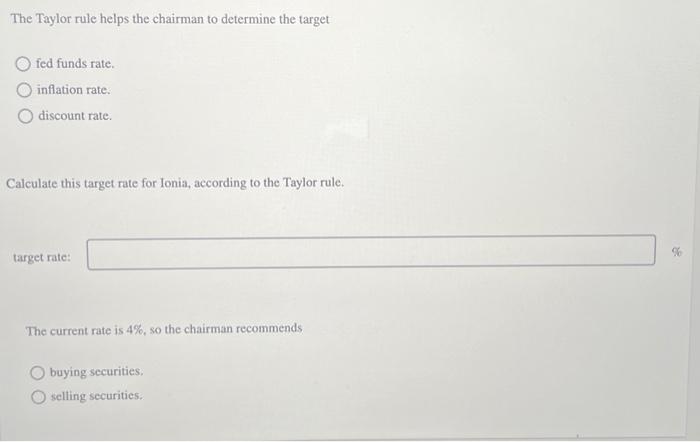

Impact on Monetary Policy, The new chairman of the ionian central bank

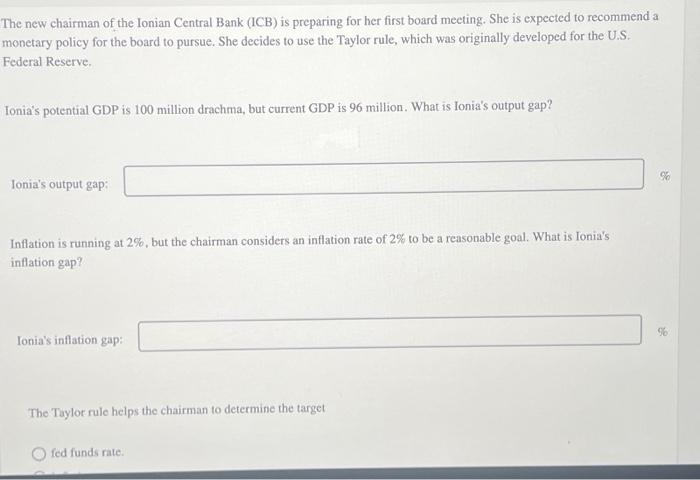

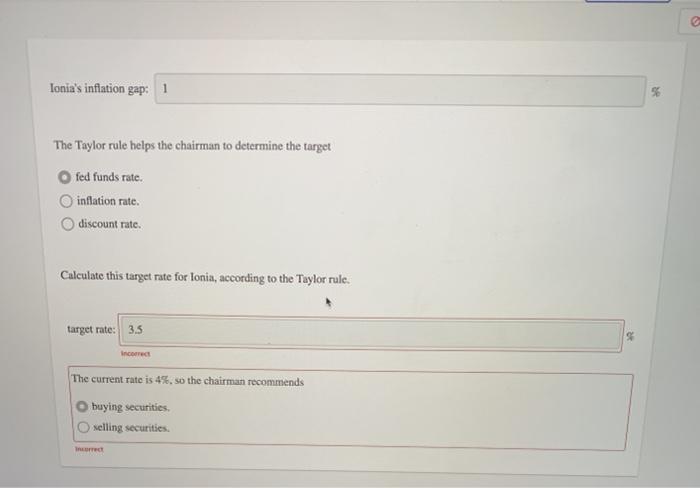

Dr. Athanasiou’s appointment is expected to have a significant impact on the Ionian Central Bank’s monetary policy. Her background in inflation targeting and financial stability suggests that she may adopt a more conservative approach to monetary policy. This could lead to higher interest rates and tighter financial regulation in the short term.

Economic Implications

The new chairman’s leadership may have broader implications for the Ionian economy. A more conservative monetary policy could slow economic growth in the short term, but it could also help to reduce inflation and maintain financial stability in the long term.

The bank’s decisions will be closely watched by businesses, consumers, and investors.

Market Reaction and Investor Sentiment

The market reacted positively to the appointment of Dr. Athanasiou. The Ionian stock market rose by 1.5% on the day of the announcement, and bond yields fell slightly. Investors are optimistic that Dr. Athanasiou’s leadership will bring stability and predictability to the financial sector.

International Relations and Collaboration

Dr. Athanasiou’s international experience and connections are expected to strengthen the Ionian Central Bank’s relationships with other central banks and international organizations. This could lead to increased collaboration on monetary policy, financial regulation, and other areas of mutual interest.

FAQ Explained

What are the key responsibilities of the new chairman of the Ionian Central Bank?

The new chairman is responsible for overseeing the bank’s monetary policy, ensuring price stability, and fostering economic growth. They will also represent the bank in international forums and collaborate with other central banks.

How is the new chairman expected to impact interest rates?

The new chairman’s views on inflation and economic growth will influence their approach to interest rate policy. They may raise interest rates to curb inflation or lower them to stimulate economic activity.

What are the potential economic implications of the new chairman’s leadership?

The new chairman’s policies could affect inflation, economic growth, and financial stability. Their decisions will have a significant impact on businesses, consumers, and the overall health of the Ionian economy.