Gary and Ann have a joint checking account, a financial arrangement that can offer convenience and benefits but also potential drawbacks. This comprehensive guide delves into the intricacies of joint checking accounts, exploring their legal, financial, and tax implications, as well as providing practical tips for managing them effectively.

From the legal responsibilities associated with joint ownership to the tax consequences of shared funds, this guide provides a thorough examination of the complexities involved in maintaining a joint checking account. By understanding the potential advantages and pitfalls, couples can make informed decisions about whether a joint checking account is right for them.

Gary and Ann’s Joint Checking Account

A joint checking account is a type of bank account that is owned by two or more people. It allows all account holders to deposit and withdraw money, write checks, and use debit cards. Joint checking accounts can be a convenient way to manage finances for couples, roommates, or business partners.

Benefits of Having a Joint Checking Account

- Convenience: Joint checking accounts make it easy for multiple people to access and manage their finances together.

- Shared expenses: Joint checking accounts can be used to pay for shared expenses, such as rent, utilities, and groceries.

- Emergency funds: Joint checking accounts can be used to save for unexpected expenses.

Drawbacks of Having a Joint Checking Account

- Lack of privacy: All account holders have access to all transactions, which may not be desirable for everyone.

- Overspending: It can be easier to overspend when you have a joint checking account, as multiple people may be contributing to the account.

- Liability: All account holders are jointly liable for any debts incurred on the account.

Tips for Managing a Joint Checking Account Effectively, Gary and ann have a joint checking account

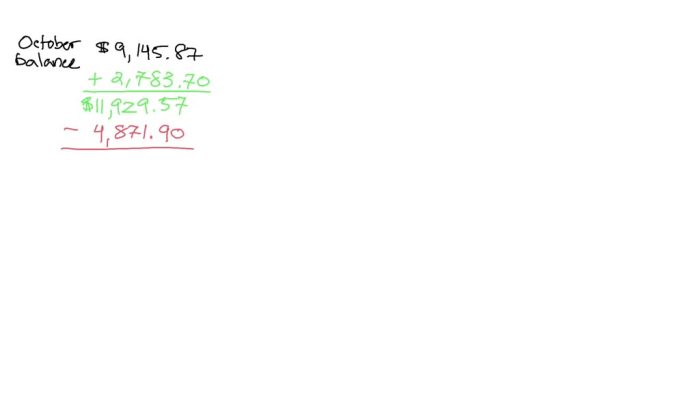

- Set up a budget: Create a budget to track your income and expenses, and make sure that both account holders are aware of the budget.

- Communicate regularly: Talk to your account holders regularly about your financial goals and any changes to your budget.

- Resolve disputes quickly: If you have a disagreement about how to manage the account, resolve it quickly to avoid any unnecessary stress.

Legal and Financial Implications

Legal Implications of Having a Joint Checking Account

- Ownership: All account holders have equal ownership of the funds in the account.

- Authority: All account holders have the authority to make deposits, withdrawals, and write checks.

- Liability: All account holders are jointly liable for any debts incurred on the account.

Financial Implications of Having a Joint Checking Account

- Credit score: A joint checking account can affect your credit score, as both account holders’ financial activity will be reported to the credit bureaus.

- Taxes: Joint checking accounts are taxed jointly, which means that both account holders are responsible for paying taxes on the interest earned on the account.

- Estate planning: A joint checking account can affect your estate plan, as the funds in the account may be subject to probate.

Advice on How to Protect Yourself Financially When You Have a Joint Checking Account

- Monitor your account activity regularly: Keep track of all transactions on the account, and report any unauthorized activity to your bank immediately.

- Set up a separate account for personal expenses: If you are concerned about overspending, consider setting up a separate account for your personal expenses.

- Consider a prenuptial agreement: If you are getting married, consider signing a prenuptial agreement that Artikels how your finances will be managed in the event of a divorce.

Tax Implications: Gary And Ann Have A Joint Checking Account

Tax Implications of Having a Joint Checking Account

- Interest income: Interest earned on a joint checking account is taxed jointly, which means that both account holders are responsible for paying taxes on the interest.

- Gift tax: If one account holder deposits more money into the account than the other, it may be considered a gift, which may be subject to gift tax.

- Estate tax: If one account holder dies, the funds in the joint checking account may be subject to estate tax.

How to File Taxes When You Have a Joint Checking Account

- File jointly: If you are married, you can file your taxes jointly, which means that you will report the income and expenses from your joint checking account on your joint tax return.

- File separately: If you are not married, or if you choose not to file jointly, you will need to report the income and expenses from your joint checking account on your individual tax return.

Tips for Minimizing Taxes When You Have a Joint Checking Account

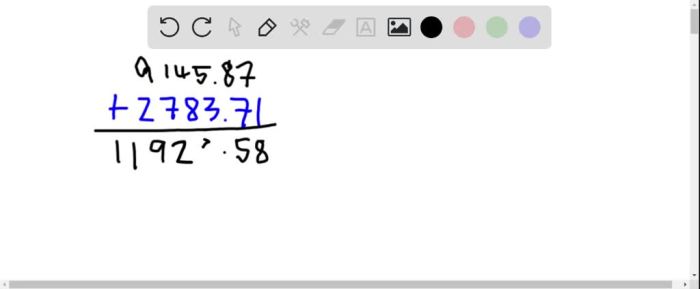

- Keep track of all deposits and withdrawals: Keep a record of all deposits and withdrawals from your joint checking account, so that you can accurately report the income and expenses on your tax return.

- Consider setting up a separate account for personal expenses: If you are concerned about overspending, consider setting up a separate account for your personal expenses. This will help you to keep track of your spending and avoid paying taxes on unnecessary expenses.

- Talk to a tax professional: If you have any questions about the tax implications of having a joint checking account, talk to a tax professional.

Estate Planning

How a Joint Checking Account Can Affect Your Estate Plan

- Probate: If one account holder dies, the funds in the joint checking account may be subject to probate, which is the legal process of distributing the deceased person’s assets.

- Estate taxes: If the value of the joint checking account exceeds the estate tax exemption, it may be subject to estate taxes.

- Beneficiaries: The funds in a joint checking account will pass to the surviving account holder(s) upon the death of one account holder.

Importance of Considering Estate Planning When You Have a Joint Checking Account

- To avoid probate: By creating an estate plan, you can avoid the probate process and ensure that your assets are distributed according to your wishes.

- To minimize estate taxes: By planning your estate, you can minimize the amount of estate taxes that your heirs will have to pay.

- To protect your beneficiaries: By creating an estate plan, you can protect your beneficiaries from financial hardship in the event of your death.

Tips for Estate Planning When You Have a Joint Checking Account

- Create a will: A will is a legal document that Artikels your wishes for the distribution of your assets after your death.

- Create a trust: A trust is a legal entity that can be used to hold and manage your assets after your death.

- Talk to an estate planning attorney: An estate planning attorney can help you to create an estate plan that meets your specific needs.

Other Considerations

Factors to Consider When You Have a Joint Checking Account

- Trust: It is important to have trust in the other account holder(s) before opening a joint checking account.

- Communication: It is important to communicate regularly with the other account holder(s) about your financial goals and any changes to your budget.

- Financial goals: It is important to make sure that your financial goals are aligned with the other account holder(s) before opening a joint checking account.

Tips for Communicating About Money with Your Partner

- Be open and honest: Be open and honest with your partner about your financial situation and your financial goals.

- Create a budget together: Create a budget together so that you can track your income and expenses and make sure that you are on the same page financially.

- Talk about your financial goals: Talk to your partner about your financial goals and how you plan to achieve them.

How to Resolve Financial Disputes with Your Partner

- Stay calm: When you have a financial dispute with your partner, it is important to stay calm and avoid getting emotional.

- Communicate openly: Talk to your partner about your concerns and try to understand their point of view.

- Be willing to compromise: Be willing to compromise so that you can reach a solution that works for both of you.

Answers to Common Questions

What are the benefits of having a joint checking account?

Joint checking accounts offer convenience, shared access to funds, and simplified bill payment. They can also facilitate financial planning and budgeting as a couple.

What are the potential drawbacks of having a joint checking account?

Joint checking accounts can lead to financial disputes if not managed properly. One account holder’s spending habits can impact the other, and there is a risk of overdraft fees if funds are not carefully monitored.

How can couples manage a joint checking account effectively?

Effective communication, clear expectations, and responsible financial management are essential. Couples should discuss spending habits, set financial goals, and establish a budget to avoid misunderstandings.